The Province says more than 1.9 million Alberta utility customers can expect relief for their rising natural gas and electricity bills, but not for some time.

The new Electricity Rebate Program is set to cover overages paid by consumers in the first three months of 2022, when rates were high. The Province said it is working with power companies to ensure that savings are applied directly to bills from January, February and March.

Customers will receive three $50 rebates, for a total of $150 if their electricity use is less than 250 megawatt hours per year.

However, Associate Minister of Natural Gas and Electricity Dale Nally said the earliest those savings will be applied to bills is June, possibly July, as the power companies work to adjust their billing systems.

New legislation is needed to implement these rebate programs, as the existing Natural Gas Price Protection Act does not allow for such programs, Nally said. This is significantly extending the predicted timeline.

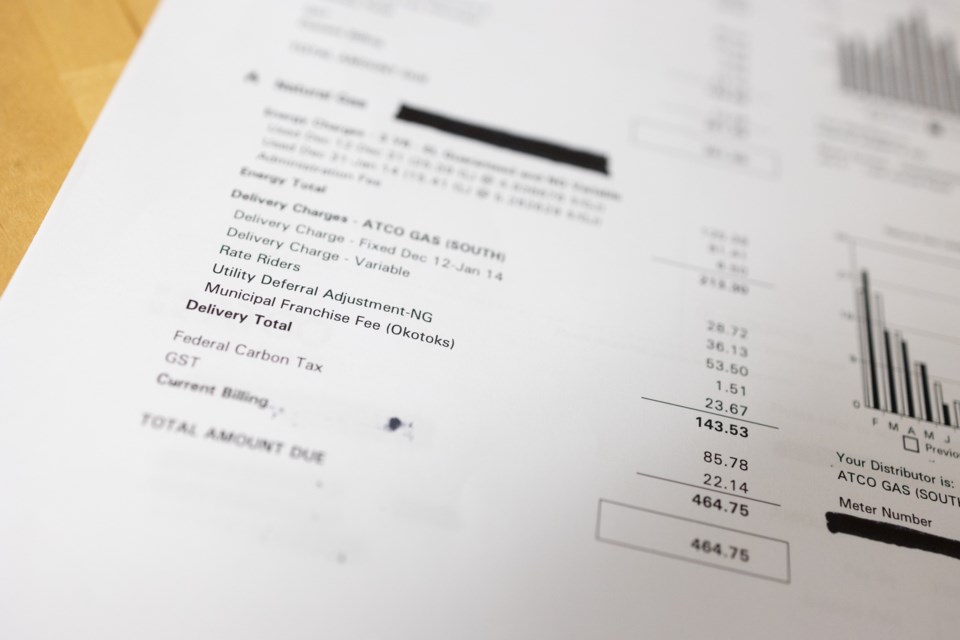

Relief for high natural gas bills through the Natural Gas Rebate Program will not arrive until October. The province said that natural gas rebates will be introduced when regulated natural gas rates exceed $6.50 per gigajoule, but only from Oct. 1, 2022, to March 31, 2023.

Natural gas usage is highest in the fall and winter which informed the time period for the rebate, Nally said. The province didn’t indicate a specific dollar amount or procedure for this program.

Bill 18, the Utility Commodity Rebate Act was introduced by Nally in the legislature April 20. If passed, the bill would come into effect following receipt of royal assent by the lieutenant governor. The province said this is to avoid further delays.

Although the province has indicated the intention to move swiftly on the matter, specific elements, including how the rebates would be passed on to renters, who pay natural gas via rent through a property company or landlord have yet to be determined.

Nally said during his remarks Wednesday that the “Liberal-NDP alliance’s punishing carbon tax” is to blame for increased cost to consumers.

However, the same day, the University of Calgary School of Public Policy released a report indicating that was not the case.

The report authored by Blake Shaffer, David Brown and Andrew Eckery, said that the sudden jump in prices is largely composed by a change in ‘market mark-up.’

In provinces outside Alberta, regulated utilities pass on all costs to consumers through regulated rates. Generators compete in an open market in Alberta, “with no guarantee the revenue they earn will be sufficient to recoup their fixed costs of investing in power plants,” the report wrote.

To cover all bases, companies need to earn revenues substantially over the costs associated with generating power, it explained.

In 2020, the market mark-up was nine dollars per megawatt hour. According to Shaffer, Brown and Eckert, that price quadrupled in 2021 to $44 per megawatt hour.

To compare, the report indicates that the change in carbon tax pricing over that year increased only $2.53 per megawatt hour.

The price for wholesale power in Alberta also more than doubled in 2021 – from $48 dollars per megawatt hour in 2020 to over $105.

“It’s not saying the carbon tax is not to blame, it acknowledges that there’s a contribution of the carbon tax,” Nally said during a press conference. “It also acknowledges that the fees and the administration take up about 60 per cent of people’s bills and that’s also contributing to the higher costs.

“And yes, the report also recognizes that we just came through a period of unprecedented demand on the electricity system and that contributed to a spike in prices.”

Nally reiterated that the UCP’s move to introduce Bill 18 and all associated programs are sufficiently more helpful than the actions taken by the NDP government during its tenure.

The minister claimed that the electricity rate cap introduced by the NDP only applied to half of consumers but did not provide a specific number.

He continued to say that this is more “meaningful relief” than that of the previous government, citing a higher financial investment.