INNISFAIL – When the province’s latest COVID-19 restrictions were announced last week, Mark Kemball’s first reaction was one of profound sadness for the local business community.

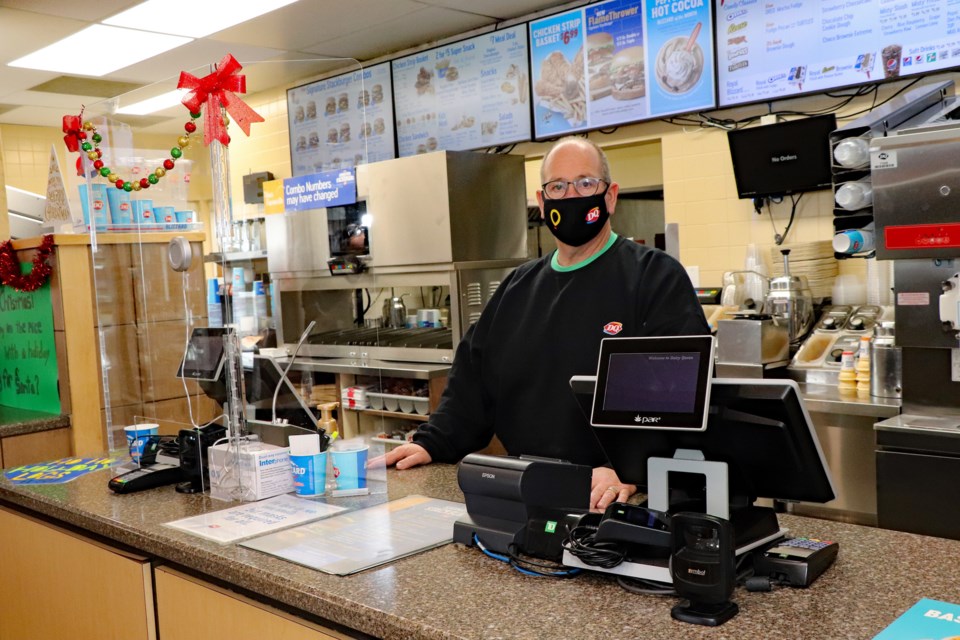

“I just feel for businesses that have put their hearts and souls at finances on the line and due to circumstances that they can not control they could lose everything,” said Kemball, a long-time community and business leader, and owner of the town’s Dairy Queen outlet. “I guess I feel deflated and sad.”

And perhaps with a huge unsettling feeling of déjà vu. The Dec. 8 provincial COVID-19 measures triggered the second big shutdown since the pandemic began last March. The first shutdown in the spring lasted two months. This time around it will go for at least 28 days.

However, it could prove too much for some businesses who were able to tough it out the first time. Some may soon have to shut their doors for good. Employees will be laid off again. Owners will take additional hits, like still paying rent and other necessary expenses, including utilities and product losses.

As of Dec. 13, shopping malls and retail businesses must reduce customer capacity to 15 per cent of fire code occupancy, with a minimum of five customers permitted.

“This is really their time of year to make hay. Christmas time is their largest sales,” said Kemball. “Even if people want to shop it is going to be difficult to monitor that 15 per cent capacity. I just hope their sales can hang in there to make it through.”

While retail stores can stay open in a limited capacity, the new measures will be especially hard on restaurants, pubs, bars, lounges and cafes. As of Dec. 13, they will all be closed to in-person service. They are allowed only takeout, curbside pickup and home delivery.

“I know and they know the take-out business will not be as strong as the sit-down business. It just will not be,” said Kemball. “Their whole business model is based on the whole social interaction of breaking bread together, and that is taken away.

“We have such great restaurants in this town and I just hope they can weather this storm because it’s just sad. It’s devastating,” he added. “Can they survive with take out? Hopefully. But it is not their business model, and so they really have to adapt. It’s not going to be easy.”

In the meantime, Kemball has prepared for his own Dairy Queen to weather the storm of a second shutdown. He still has about 30 full and part-time staff working for him, the same number he had at the beginning of the pandemic.

He will be closing his dining room and there will be no indoor seating but patrons will still be allowed to come inside and order food to go. Drive-thru service will continue.

The 28-day shutdown measures also include casinos, bingo halls, gaming entertainment centres, racing entertainment centres, horse tracks, raceways, bowling alleys, pool halls, legions, and private clubs.

As well, libraries, science centres, interpretive centres, museums, galleries, amusement parks and water parks will be closed. The mandatory closures also cover personal and wellness services, including hair salons, nail salons, massage, tattoos, and piercing.

To help with the inevitable hardship facing businesses, the province is expanding and increasing the Small and Medium Enterprise Relaunch Grant, which will have a new lower threshold and increased grant amount. The total potential funding available has been raised to $20,000 for each business, up from the original $5,000.

While some assistance is always helpful, Kemball believes it’s “probably” not enough.

“I think this is designed if you have to close your doors totally,” he said. “This may help with some of the expenses that are going to be there regardless but I don’t know if it is enough to save (them).”

As far as the ongoing federal support, Kemball said it has helped employees who have been laid off through the CERB program but when businesses have been able to reopen it has been challenging to lure staff back to work.

“It’s a Catch-22 situation,” he said. “The businesses need the help but I see employees needing help as well so where does that end and how do you determine what the balance is. It’s really tough.”

And then there is also the growing federal and provincial debts that keep increasing and must ultimately be dealt with before the country and province faces a new calamity and additional hardship.

“When do you stop the programming and when do you get people back to work and start biting into this debt? It’s just crazy. I don’t think any of us has seen anything like this,” said Kemball, who despite the immediate obstacles and the uncertain future still retains optimism that locals and all Albertans and Canadians will persevere and meet every challenge ahead of them.

“We are somehow going to get through this. I just know it,” said Kemball."I just know we are going to come out stronger on the other side. You and I both know this province was built on entrepreneurial spirit."

“I don’t know how many times we’ve been kicked and batted down but we’ve always seemed to rise from the dust somehow, and I hope again this will happen.”