INNISFAIL – The once-feared tax pain for Innisfail residents in 2025 appears to have eased.

That won’t be known for sure until Dec. 9 when Innisfail town council votes on local taxes for 2025 but there is now hope it won’t be as onerous as it was before 2025 budget deliberations began last week.

Following two and half days of intense deliberations that began Nov. 19, senior town staff went “line by line” to make $213,250 worth of savings or cuts for the final day on Nov. 22.

They finished up with a proposed 3.06 per cent tax increase for both residential and non-residential properties. That’s less than half of the 6.53 per cent that had been floated before deliberations began.

For 2024, locals were ultimately handed a 2.8 per cent tax hike.

“I would say in my seven years (on council), maybe this budget has been the most difficult,” said mayor Jean Barclay, who saluted senior staff “to get to a place” on the tax front where the town remains “extremely competitive” in the region. “Affordability is always top of mind for us. There's been so many increases in so many areas for residents, for families, whether it's groceries or auto insurance, electricity bills and so on.

“I think a lot of the discussion these last three days has been around affordability, and yet at the same time we have the same issues that are facing us through inflationary pressures, or as we've seen in the asset management plan, there's so much that needs to be done to keep our infrastructure in working condition.

“I think we've settled at a really good place.”

Mostly though, town staff worked diligently with town council to create a budget for 2025 that will maintain existing essential services, while at the same time keeping a careful eye to the future to ensure the town has enough funding to upgrade critically important infrastructure, like roads, water and sewer lines.

Recognizing the town has a worrisome $1.6 million infrastructure deficit, the 2025 budget process made enough savings to be able to include the first of eight $200,000 additions to reserves until 2033.

“We are going to do that slowly. If we start in 2025 we will get there in 2033,” said Erica Vickers, the town’s director of corporate services. “We will be transferring that $200,000 per year going forward on top of our current investments.”

Barclay credits the town’s Asset Management Plan for keeping the municipality on track to correct its infrastructure deficit.

“We never had the asset management tool in the past, not to the extent that it is now,” said Barclay. “So now we can see a glimpse into how much we are under funding.

“And it's not just Innisfail. It's likely most municipalities in Alberta.”

Budget 2025 is also calling for greater tax equity with all properties in the community, notably dozens that are tax exempt like schools, Autumn Grove and the Innisfail Health Centre, through a proposed one per cent FortisAlberta franchise fee increase that will generate $110,729.

“We have about 75 properties throughout Innisfail that don't pay taxes that will now see a one per cent franchise fee increase,” said Vickers. “So, we are spreading that increase out over more ratepayers than just doing a tax increase.”

The average FortisAlberta user, based on 650 kilowatt hours per month, will see a monthly increase of about $1.26.

Council and staff are also proposing utility rate increases.

Water rates will rise from $3.01 in 2024 to $3.26 per cubic metre next year, a 25-cent increase, and sewer rates will increase from $4 this year to $4.31 per cubic metre in 2025, a 31-cent increase.

These changes will result in an average monthly increase of $5.60 on water bills. All flat charges will remain the same.

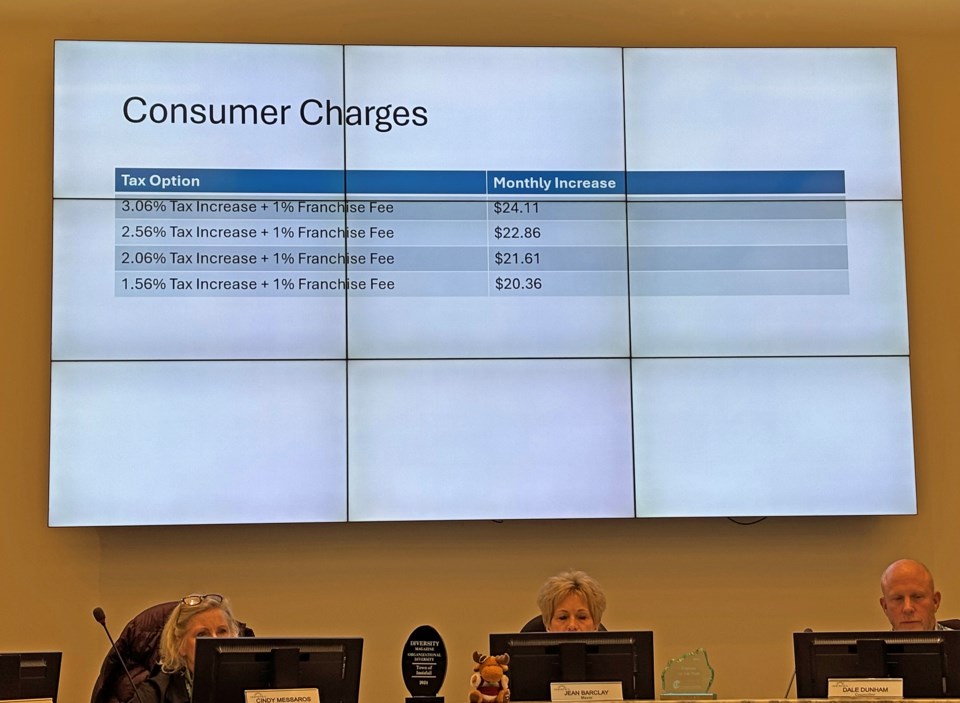

So, with an assessment growth example of four per cent and a projected 3.06 per cent tax increase on an average $400,000 home, there could be an approximate monthly tax increase of $17.25 per month in 2025 over the year before.

Factoring in the one per cent FortisAlberta increase with hikes to utility bills, the approximate total monthly household increases in 2025 over the year before will be about $24.11.

Vickers told the Albertan that final figures for 2025 assessment growth, currently estimated by Wild Rose Assessment Services to be about 6.7 per cent, are expected to arrive in February.

As well, the 2025 budget is not forgetting the town’s current plan to modernize the Innisfail Aquatic Centre. The town will have saved $1,629,846 in reserves by the end of 2024 for a future debenture payment if it moves forward on a major renovation to the existing facility.

In the meantime, the town’s 10-year capital plan has already identified a necessary $10 million investment for upgrades at the Innisfail Twin Arena, but decisions on that are still years away.