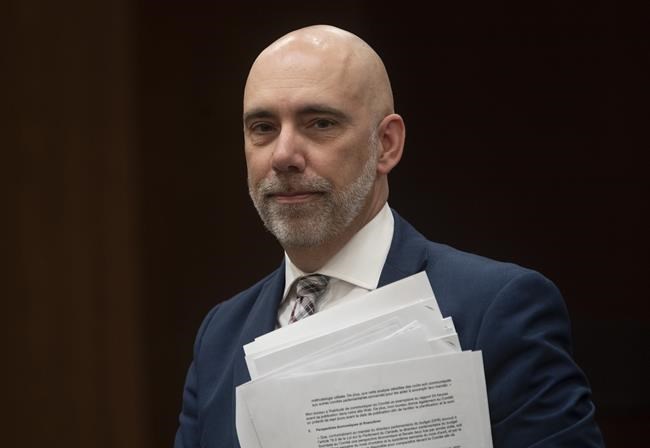

OTTAWA — The parliamentary budget officer says the federal government has the wiggle room to add billions more in permanent spending before its finances become unsustainable.

Based on the budget officer's calculations, the government could increase annual spending, reduce taxes, or a combination of the two to the tune of $19 billion and still reduce the debt-to-GDP ratio over time to pre-pandemic levels.

That's down from the $41 billion the budget officer calculated in February before the COVID-19 pandemic sent the economy into a downturn and oil prices into a steep slide.

And Giroux's report warns the same can't be said of many provinces, the territories, local or Indigenous governments.

Under current spending plans, many will see debt growing continuously as a share of the economy, which would put pressure back on federal books.

"It's the same taxpayers supporting the sustainable federal government and the unsustainable provinces and territories," Giroux told reporters in a virtual briefing.

"If the federal government wishes to use all of its fiscal (space) on new spending, for example, it means that provinces and territories will have to either increase taxes or reduce services, which will be borne by the same taxpayers."

He estimates permanent tax increases or spending cuts totalling about $12 billion, and growing in line with gross domestic product over time, would be needed to stabilize the finances of lower levels of governments.

Only three provinces have finances that are considered sustainable in Giroux's view: Quebec, Nova Scotia and Ontario, each of which have varying levels of room to bump up permanent spending or to cut taxes if they choose.

The report's findings on Ontario were written before Thursday, when the provincial government tabled a budget with deficit and spending projections.

The federal Liberals have yet to do the same, but have promised a fiscal update some time this fall, a date for which has yet to be set. Nor has the government provided any new numbers about the size of this year's deficit, the overall federal debt or the potential ballooning cost of servicing that debt should record-low interest rates begin to rise.

A one-time economic shock has implications for the fiscal room governments have, but what matters more are permanent spending or tax changes, Giroux said.

And what's more, he noted that not all spending is equal: Programs that boost productivity and economic output, as well as expand the tax base, could add some fiscal flexibility.

"It's a matter of policy preferences," Giroux said.

The Liberals have vowed new spending on programs like national child care, and also to extend temporary measures for as long as the economy remains weighed down by COVID-19.

The government added more spending to its package of pandemic aid on Friday, announcing $155 million more for a wage subsidy program targeting tech startups, with support based on revenue losses.

The program for startups mirrors the changes the Liberals want to make in the larger wage subsidy program, in a bill the House of Commons approved Friday.

The legislation would extend the federal wage subsidy until next summer, cancelling a previously planned decline in its value, as well as expanding a popular business loan program.

The legislation would also redo a rent relief program that was widely criticized because its original design needed buy-in from landlords, many of whom did not participate.

And it would also provide top-up help for businesses whose revenues crash because of local lockdowns to slow the spread of COVID-19.

The Senate must still pass the legislation before its provisions can be enacted.

This report by The Canadian Press was first published Nov. 6, 2020.

Jordan Press, The Canadian Press