TORONTO — A regulatory filing shows the Canadian branch of Silicon Valley Bank is not part in First Citizens' purchase of most of the failed U.S. bank.

The U.S. 8-K filing shows that the Canadian, German and Hong Kong branches of Silicon Valley Bank will instead be available as an option for First Citizens to purchase.

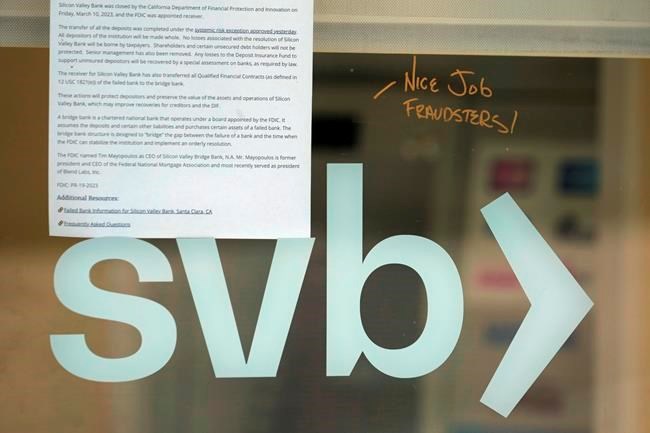

Canada's banking regulator moved to seize the Canadian assets of Silicon Valley Branch as the parent bank collapsed, then secured a winding-up order that's designed in part to assist with a potential transition of the Canadian branch operations.

The wind-up order granted by the Ontario Superior Court of Justice also provide the framework for a future liquidation if no other option is possible.

PricewaterhouseCoopers Inc., which has been appointed by the court to oversee the transition, didn't respond to a request for comment on how the sale to First Citizens, announced late Sunday, might affect the Canadian branch.

The Canadian branch of Silicon Valley Bank was especially active with startup funding in Canada's tech sector, but the assets of the bank and substantially all of its deposits were transferred to the bridge bank set up by U.S. regulators as part of efforts to keep U.S. operations running.

This report by The Canadian Press was first published March 27, 2023.

The Canadian Press