OTTAWA — A motion increasing the proportion of capital gains that are taxed in Canada easily passed the House of Commons Tuesday, as the governing Liberals and Conservatives traded barbs about whether it will harm the middle class or make the country's wealthy pay more.

The NDP, Bloc Québécois and Greens voted with the Liberals in favour of the motion while the Conservatives voted against, moving it past the finish line with the tax adjustment now set to take effect June 25.

Finance Minister Chrystia Freeland looked extremely pleased as she gathered her belongings in the House of Commons after the vote. The measure was a key part of her recent federal budget and she introduced it as a stand-alone motion Monday in a challenge to the Conservatives to vote against "generational fairness."

"We are stepping up for Canadians, the Conservatives are stepping up for the rich," Prime Minister Justin Trudeau shouted in question period.

"Mr. Speaker, if it did not have real world impacts on Canadians, it would almost be amusing to watch the Conservative leader tie himself in knots to try and justify voting in favour of advantages for the wealthy Canadians when they sell really profitable investments."

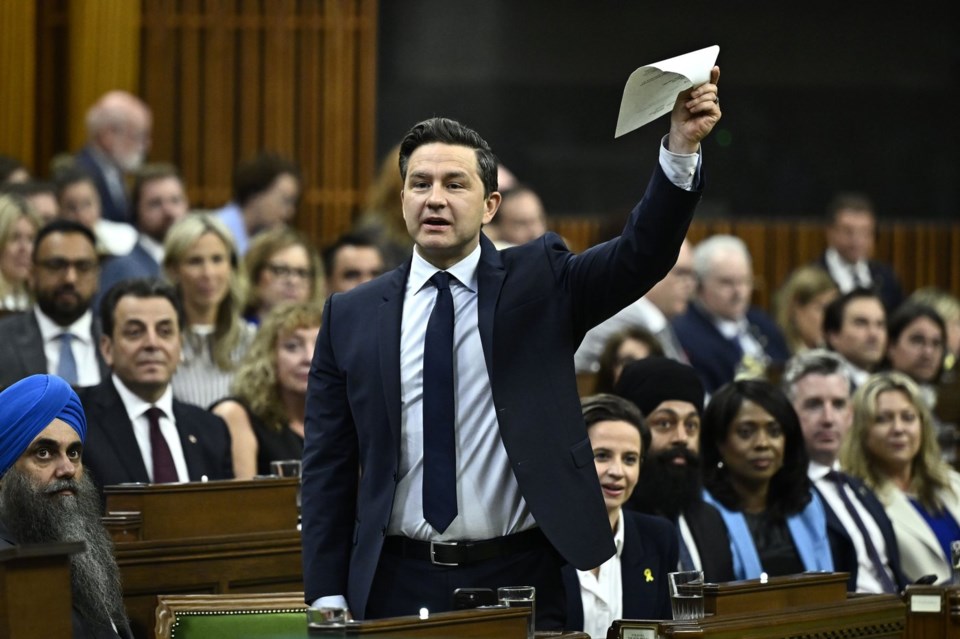

Not so, responded Conservative Leader Pierre Poilievre, who insists the wealthy will find ways to move their money out of Canada to avoid paying the tax, which will negatively affect farmers, small businesses, doctors and homebuilders.

"Why is it that every time the prime minister mentions the middle class, they get poorer," Poilievre exclaimed.

The Conservatives had not taken a stance on the tax change until Tuesday. But in a statement released just over an hour before the vote, the party indicated it would not support it, pointing to its impact on farmers, homebuilders, small business owners and doctors.

"It is incredible that during a housing shortage, he wants to tax homebuilders," Poilievre said in the House. "During a health care shortage, he wants to tax away our doctors. During a food crisis, he wants to tax our farmers. And while our economy is shrinking more than any other economy in the G7, he wants to tax our small business job creators. Is this not the definition of insanity?"

Currently Canadians pay tax only on 50 per cent of their capital gains, or the profits they make on the sale of assets like secondary residences and stock options. The change means corporations will all now pay tax on 66 per cent of capital gains. Individuals will pay 66 per cent on any capital gains that exceed $250,000 in a single year.

Freeland says primary residences will continue to be exempt and insists the move is to level the playing field between wealthy Canadians who earn most of their income from the sale of investments, and middle and lower income Canadians who earn most of their income from jobs. She said Monday that under the current policy, really wealthy Canadians often pay a lower tax rate than middle income Canadians.

"We are asking them to pay a little more so we can invest more in housing for young people to be able to have the same kinds of opportunities previous generations did," Trudeau said in question period Tuesday.

A statement by The International Monetary Fund on Tuesday, written by IMF staff after concluding a regularly scheduled visit to Canada, was quietly positive about the capital gains change. The preliminary concluding statement said the change "improves the tax system’s neutrality with respect to different forms of capital income and is likely to have no significant impact on investment or productivity growth."

The IMF was positive about Canada's ability to avoid a recession this year and get inflation under control, but was critical of the high cost of housing.

The Grain Growers of Canada say that with more than one-third of farmers likely to retire in the next decade the capital gains tax increase is extremely harmful.

“This hike targets farmers' retirement plans, complicates intergenerational transfers, and threatens the long-term viability of family farms across the country," executive director Kyle Larkin said.

The Canadian Federation of Independent Business wanted the government to put the changes on hold until small businesses could better understand the impact, with more than half its members fearing the changes will affect them should they choose to sell their business.

Bea Bruske, the president of the Canadian Labour Congress, was critical of Poilievre's decision to vote against the motion, calling it "fundamentally unfair."

“With this vote Mr. Poilievre has shown that he believes that an ordinary worker flipping burgers for a living should be taxed on 100% of their income while his CEO friends making millions of dollars from flipping stocks should be taxed only on half of that income," she said.

The change is expected to raise $19 billion over five years. Freeland said that means Canada can make "fiscally responsible" investments that help the middle class, including on health care, homebuilding, child care and dental care, without going deeper into debt.

This report by The Canadian Press was first published June 11, 2024.

Mia Rabson, The Canadian Press