OTTAWA — The federal government is rolling out billions in new financial help targeting hard-hit sectors of the economy, acknowledging that some companies need more support while others are slipping through the safety net of emergency aid.

The combined package of spending and loans will target the oil and gas sector, small companies that haven't been able to access existing loan programs, and start-ups that had just got off the ground before the pandemic struck last month.

Since then, the economy has gone into a tailspin.

The latest figures the federal government has provided about the Canada Emergency Response Benefit, which will now be updated and published regularly, show the program has paid out $17.35 billion to date.

The Liberals budgeted $24 billion for the program, which provides $2,000 a month to eligible workers to a maximum of 16 weeks. So far, there have been almost 6.4 million unique applicants for the program, which is to expand to capture seasonal workers and those who have seen a steep drop in their earnings.

The government hasn't provided an updated cost for the program since the promised expansion made earlier this week, saying it was reliant on how many of those workers are rehired by companies that receive help through a $73-billion wage subsidy program that will begin paying out the first week of May.

Speaking at a midday press conference, Finance Minister Bill Morneau said the government was working on additional measures for businesses to bridge the downturn.

- RELATED: Freeze carbon tax, delay new climate regs during virus crisis, oil lobby asks

- RELATED: Trudeau commits $500 million to arts, culture and sports sectors affected by COVID-19

He rejected the idea of taking equity stakes in big businesses, as federal and provincial governments did with the big automakers during the economic crisis just over a decade ago, saying that's not what the companies wanted now.

What they want and need is access to credit, Morneau said, suggesting that government-backed or low-interest loan programs could be used for other sectors in need of extra help, like restaurants, tourism and air travel.

"I think you'll see similar approaches in everything we're doing," Morneau said via videoconference Friday.

"We're trying to make sure that credit that gets delivered can be delivered through the financial institutions that organizations large and small already have relationships with."

On Friday morning, the Liberals announced a slew of new programs that totalled nearly $4.2 billion, although the specific details of the program had yet to be publicly posted by mid-afternoon.

There will $1.7 billion to help clean up "orphaned wells" in oil-producing provinces, and a $750-million fund to cut methane emissions by providing loans to companies.

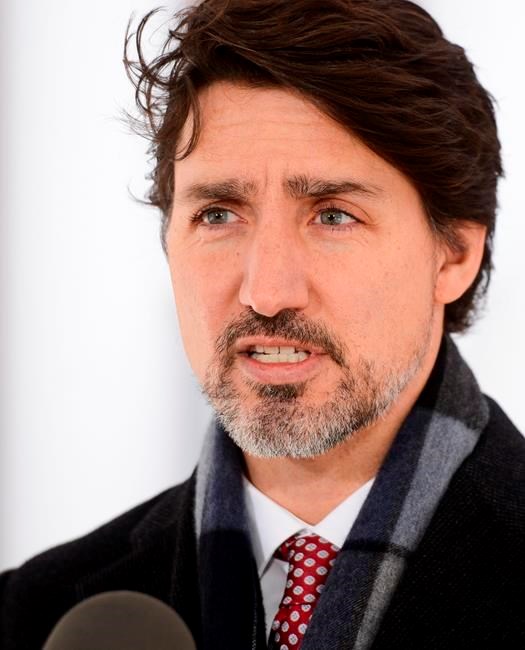

Speaking outside his Ottawa residence, Prime Minister Justin Trudeau said the government expects all the spending to maintain 10,000 jobs across the country in the oil sector as it faces plummeting prices from decreased demand and a glut of global supply.

"Certain industries are facing even more difficult times," Trudeau said.

"The oil and gas sector, because of the global price war, because of the lowered demand related to COVID and because of the measures brought in to counter COVID itself, those families are particularly hard-hit."

The government is also promising $962 million to regional development agencies to help small businesses that don't have relationships with traditional financial institutions, and others in rural parts of the country.

A further $270 million was pledged for entrepreneurs who don't qualify for the wage subsidy yet still need the help, and $500 million more in support for the arts and culture industries.

Trudeau and provincial premiers spoke this week about how to begin reopening sectors of the economy in phases. Asked about it Friday, Trudeau said approaches will vary by region and industry with an eye towards ensuring the country doesn't have to fall back into self-isolation restrictions meant to curb the pandemic.

This report by The Canadian Press was first published April 17, 2020.

Jordan Press, The Canadian Press